Good evening! Arrival Line brings you the daily summary of closing markets

🗽 On the streets of Wall Street:

US stocks ended today’s session, which was marked by volatility, with numbers in the red after a two-day winning streak. The S&P 500 was down 0.20%, while the Dow closed 0.14% lower. On the other hand, Nasdaq Composite (CCMPDL) yielded 0.25%.

On Wednesday, investors received new data showing that companies hired at a strong pace in September, indicating that The demand for workers is maintained despite the economic uncertainty. This scenario can It complicates the Fed’s fight to suppress the highest rate of inflation in four decades and fuels fears of a recession.

The outlook now hangs on Friday’s government payroll report, which is expected to show another strong month of job creation and the unemployment rate remaining near a 50-year low.

Traders also watched comments from San Francisco Fed President Mary Daly, who Noting that it is difficult and a “real challenge” for the Federal Reserve to slow the pace of gains by 75 basis points, Dimming the odds that the US central bank It may ease the tightening policy soon. “We rely on data. When the data shows what we need to see, we will slow down.”

Price pressures will remain severe for some time, however The Fed could be closer to making smaller incremental increases than not doing so, It’s risky to play with this by offering a “cap rate”, said Biban Ray, head of North American currency strategy at CIBC.

🔑 Keys of the day:

Oil rose again on Wednesday for the third consecutive day after the Organization of the Petroleum Exporting Countries (OPEC) and its alliesCordran to reduce production by 2 million barrels per day Starting in November, which became the biggest cut since 2020.

Russia has also warned that it is considering further production cuts on a temporary basis in response to the measures taken by the United States. And other countries to limit the price of Russian oil, according to Deputy Prime Minister Alexander Novak, who also reiterated that Russia will not sell its crude to countries that limit prices.

The United States criticized the OPEC decision. This was confirmed by Karen-Jean-Pierre, White House press secretary The cut ties the group to Russia and noted that President Biden called it “unnecessary.” He also indicated that the country could release more oil from its strategic reserves to ease energy prices.

The West Texas Intermediate (WTI) For delivery in November rose 1.24 US dollars to Close at $88.09; at the same time Brent For December settlement earn $1.57 for completion US$93.72.

“In general, this was supposed to happen To be an event that reduces volatility Added support for the market. however, I think the end result could be more volatility and uncertainty in the market.” Rebecca Papin, chief energy trader at CIBC Private Wealth Management, said of the supply tightening.

👑 leader:

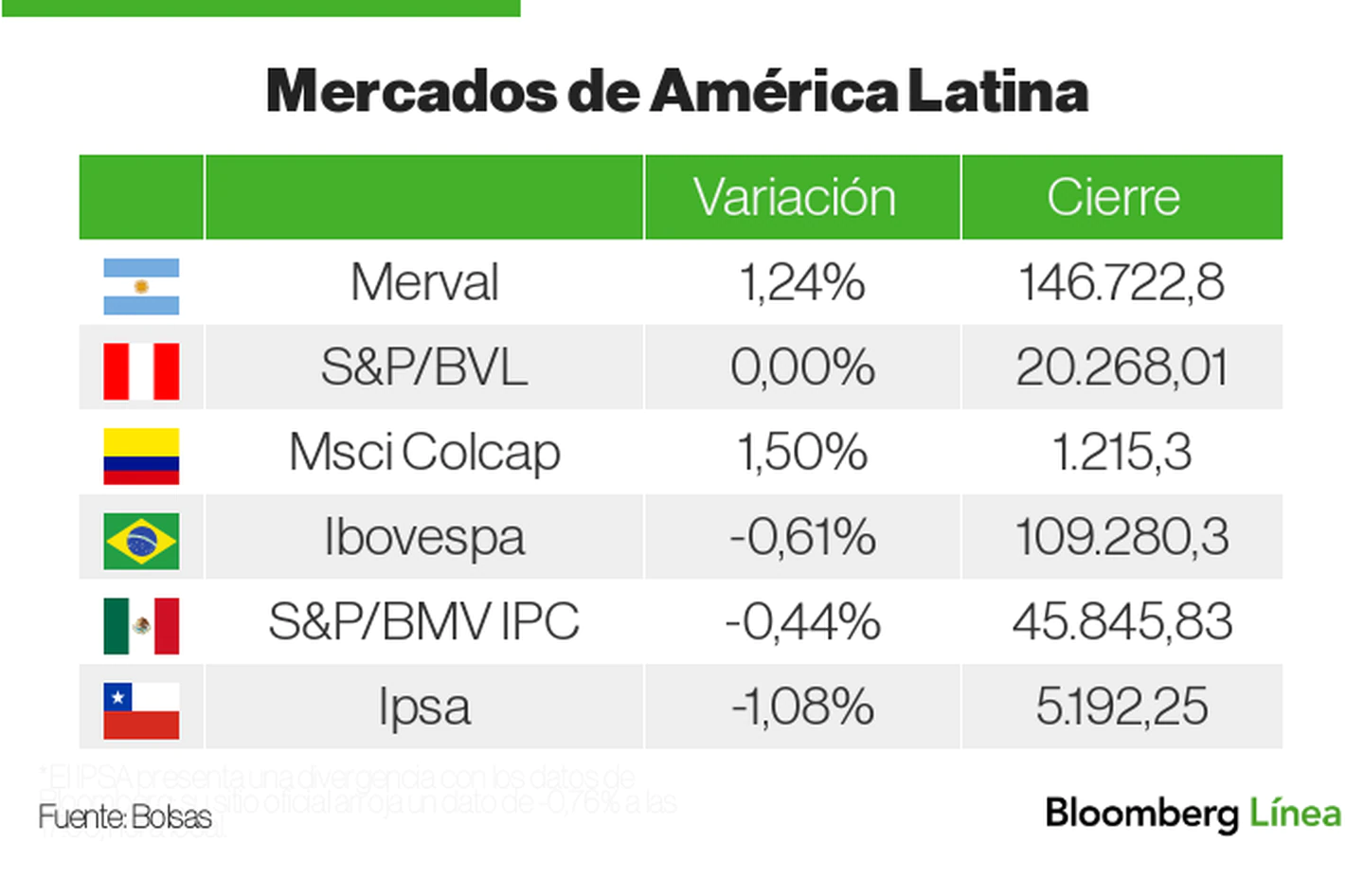

Most of the stock markets in Latin America separated themselves from the losses of the markets in the US, with the exception of the IPSA in Chile and the Mexican index that closed lower. This Wednesday, Colcap Favorite Among the region’s leading indicators, Colombia was the best performer for the second day in a row.

The Colcap Index closed 1.50% led by the good performance of the General Services, Energy and Materials sectors. yield Promigas shares (Promig), Canakol Energy (CNEC) and the ISA . group (he is) They were among those who led It increases during the day.

Gustavo Petro’s tax reform, which will require 22 billion Colombian pesos annually in packages, below the initially set target of $25 billion, will arrive at the first debate in Congress on Thursday. Amid the protests of businessmen associations They claim that it may affect future business activity and investment.

Merval Argentina (Merval) I also posted a profit today After the previous trading session, the only major indicator in the region to close with numbers in red. The Merfal index ended 1.24% higher.

📉 bad day:

epsa chile (IPSA) Those that scored the worst were their Latin American peers. The Chilean index closed at -1.08%, affected by the performance of the non-essential materials and consumer products sectors and real estate.

CAP SA shares (CHAP), urban water investments (YO SOYand Barque AraucoBaraukoIt was among the worst performing on Wednesday.

The S&P / BMV IPC Favoritefor this part, It was affected by the performance of telecom services, materials and industrial sectors.

The truth about dinner:

Elon Musk mentioned creating something called “X, the App for Everything”, Once you complete the purchase from Twitter Inc.TWTR). If some of your comments above are taken into account, this service may be very similar to the Chinese app WeChat.

Musk didn’t go into detail beyond the one-line tweet (“Twitter buys an accelerator for X creation, the app for everything”), but CEO of Tesla Inc. (TSLA) publicly praised Tencent Holdings Ltd.’s app. , which has transformed from a messaging service into a daily micro-internet More than 1,000 million Chinese.

Musk has spoken about making Twitter more useful, hinting that he wants to be like WeChat and ByteDance Ltd. It drew parallels with other “super apps” used in other parts of Asia, which allow you to do things ranging from communicating with someone, to booking travel, ordering food, paying for goods or services, or reading news.

➡️ Read more about WeChat keys that can serve as a framework for Musk’s plans

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”