Interest rate hikes, across all references: also ruled out by implied references and in the face of a very divided consensus among analysts. The decision is “consistent” with the ECB’s mandate and its new macro framework in which inflation expectations, in particular headline inflation expectations in 2023-2024, have been revised upwards, illustrated by energy. Inflation that continues to decline, and in which progress has been made, but is expected to remain very high for a long time.

- And growth? A downward review, in the foreseeable future, according to the latest data and surveys. However, there is a very significant reduction in the estimated GDP for 2024: from 1.5% to 1%. Growth was already below potential, but the risks to it are now greater. According to Lagarde, 75% of this review relates to the displacement of growth in 2023. Among the many factors that will negatively affect activity: in addition to the accumulated monetary constraints, the expected fiscal consolidation,… with regard to the transfer of monetary policy and says that it is proceeding smoothly. faster than

On other occasions, effective… - The last climb? Is the door open or closed to new heights? The statement said: “Achieving sufficient restrictive levels, which are maintained for a sufficient period, will contribute significantly to the return of prices to 2% levels.” The “data dependency” approach is maintained. Without confirming the pause

The ECB’s language seems to indicate this, although Lagarde rules out saying interest rates have reached a “peak”. Now focus on the duration of restricted rates rather than the target level. Share the meeting with the largest number of members Falcons They could have warned of raising interest rates in December if inflationary pressures persist. - on BeepNo changes were discussed. Discussion for the next few months. An important topic, given the interest rate hike, it was not logical to discuss it at this meeting. Losses in fixed income portfolios do not affect them, because their mission is price stability.

- Disagreements? CThe Council is divided, as some support a temporary pause, but a strong majority, according to Lagarde, supports the Security Council resolution.

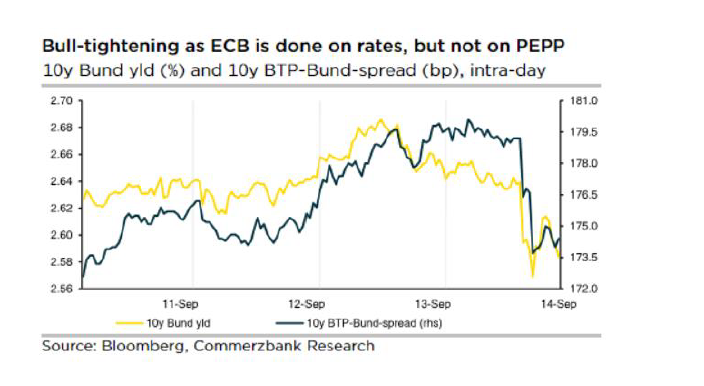

Climbs. It is expected given the complexity of the scenario and the statements we have witnessed. - Market reaction? Most noticeable in currency, with EUR/USD under single digits, and terminal spreads

narrowing; narrowing; Equity markets rise and small moves in fixed income, where short tranches have already revised their expectations days ago.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”