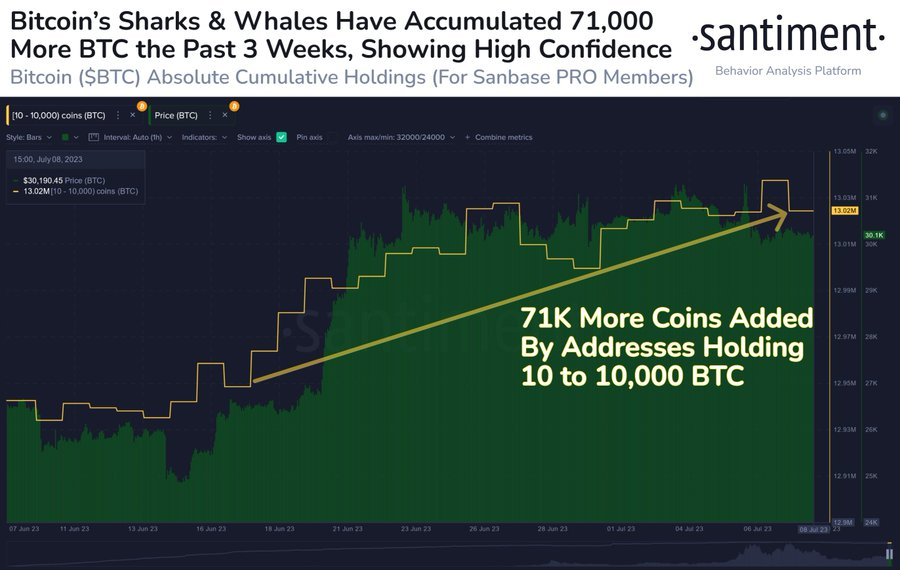

Bitcoin whale sharks have accumulated 71,000 BTC in the past three weeks when the value of the asset has been largely “flat”. US entities increased their exposure to the underlying asset during this period.

The accumulation rate is so high pregnant He points to a high conviction fueled by a series of orders for Bitcoin ETFs from traditional institutional firms.

Bitcoin whales accumulate $2.15 billion in BTC in 3 weeks

Data from the analytical signature blockchain Santiment showed that addresses holding between 10 and 10,000 BTC have been betting heavily in recent weeks.

As of June 17, these titles They have accumulated over 71,000 BTC worth $2.15 billion.

According to the market intelligence platform, I do not add Wallets with more than 10,000 BTC as these addresses usually belong to exchanges of cryptocurrencies.

This accumulation rate is a sign of high confidence in the underlying asset. But it’s even more surprising to think about it BTC price was mainly trading in the range of $30,000 and $31,000.

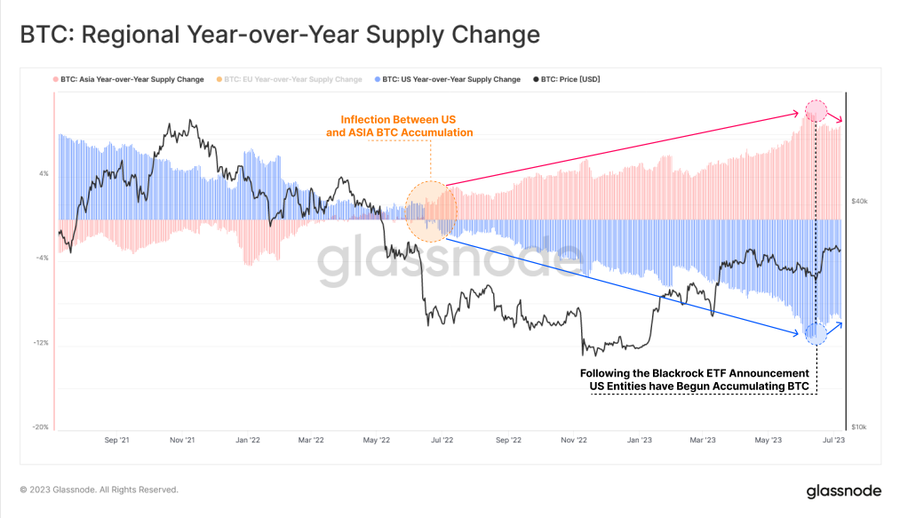

US entities pay the accumulation of BTC

The recent interest from traditional financial institutions in offering Spot Foreign Exchange Traded Funds (ETFs) has essentially fueled the current bullish sentiment around BTC.

BlackRock’s order on June 15 sparked a flood of similar requests from other financial institutions like Fidelity and others.

Glassnode, a data aggregator, also pointed it out US entities have seen a significant increase in their share of the Bitcoin supply.

The company added that this could indicate a possible change in supply dominance if the trend continues.

BeInCrypto previously reported that institutional investors have steadily increased their Bitcoin hoarding since BlackRock filed for an ETF in Bitcoin.

Many market observers have noted the massive accumulation of BTC and share this sentiment.

Crypto analyst Miles Deutscher suggested that the industry was experiencing “the beginning of a large-scale institutional buildup of BTC.” For his part, Gemini co-founder Cameron Winklevoss said:

“The Great Bitcoin Accumulation Has Begun. Anyone who watches the ETF filing series knows that the pre-IPO buying window for ETFs and floodgates is closing fast.”

BlackRock CEO Larry Fink has also changed his stance on BTC, now hailing the asset as an “international asset.” Fink believes that it could be an alternative to other assets that depend on countries’ fiat currencies.

Disclaimer

Disclaimer: In accordance with the Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article aims to provide accurate and timely information. However, readers are advised to independently check the facts and consult a professional before making any decisions based on this content.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”