The ranking of the major European and US stock markets so far this year is as follows:

. Italians + 15.08%

– Spanish + 12.83%

– French + 11.54%

– + 11.49%

– German + 10.80%

– Japanese + 7.85%

– + 6.42%

– British + 3.98%

– Chinese CSI + 2.47%

– + 0.58%

– -3.73%

Investor Sentiment (AAII)

Bullish sentiment, that is, expectations of higher prices in the next six months, rose 1.8 percentage points to 23.4%. But it is still below its historical average of 37.5%.

Bearish sentiment, that is, expectations of a price decline in the next six months, rose 6.2 percentage points to 44.8%. It is at its highest level since December 29, 2022 (47.6%) and is above its historical average of 31%.

Should we worry about the fall of SVB (NASDAQ:)? Will there be a systemic infection?

What are the things. Thursday March 9th marked the 14th anniversary of the market’s downturn with the global financial crisis. This market was created on March 9, 2009.

The annual return of the S&P 500 (not including dividends) since then is 13.5%. From the end of March 9, 2009 to the end of March 8, 2023, the S&P 500 rose +490%, which equates to an annual return of +13.5% excluding dividends.

Last Thursday was a difficult day for the markets in general and for US banks in particular. I will briefly explain what happened and the concerns that exist.

1. Who is SVB Financial?

SVB Financial, according to Statista, is the 14th largest bank in the United States based on total assets as of 2022. At the end of 2022, it had $160 billion in deposits and half of that money was invested in US Treasury bonds and US-backed securities. Pre-mortgages.

It is a bank that specializes in providing loans to technology companies, startups, and new projects related to technology. A bank that finances companies with high growth opportunities that are young.

Reuters It even says it will be the banking partner for nearly half of the venture capital-backed healthcare and technology companies listed on the stock markets in 2022.

2. What happened

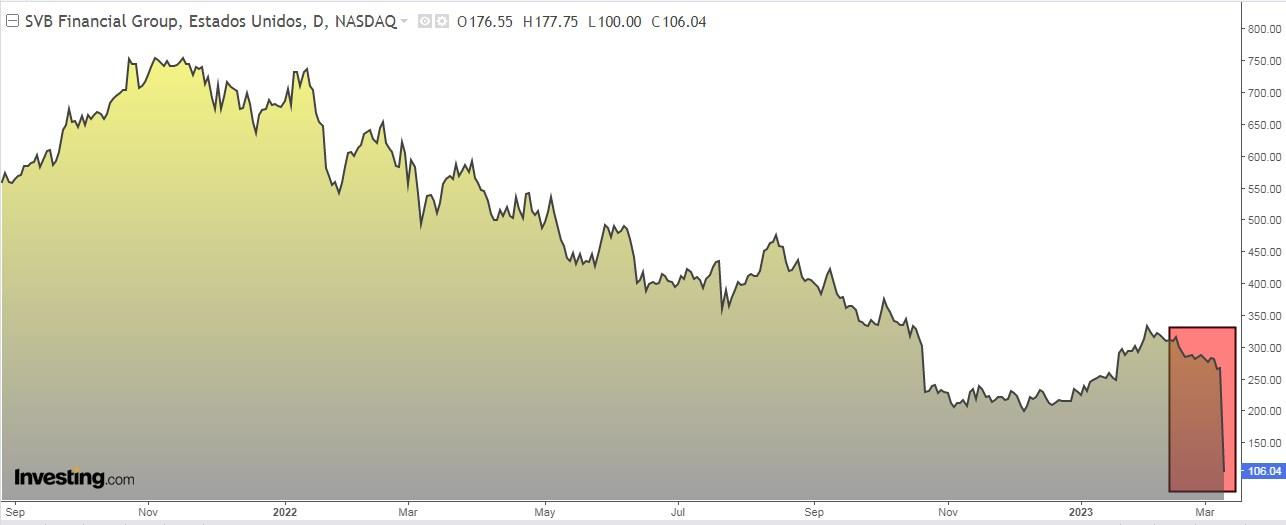

On Thursday, SVB sank -60.4% in the intraday stock market, and Friday in the pre-market plunged more than -40%.

3. Why

SVB became the biggest US financial failure in more than a decade after its tech start-up clients became anxious and withdrew deposits. Yes, it is the biggest failure of a US bank since 2008.

The massive loss of depositors forced the company to sell a $21,000m portfolio at a loss in order to get some oxygen and cash. All this led to a strong inflow of funds with constant recommendations from the managers which hastened the investors to run out of the company.

It is that the increase in interest rates has left banks loaded with low-interest bonds that cannot be sold in haste without a loss. So if too many clients connect with their deposits at once, you risk a vicious cycle.

4. The domino effect

All this spooked investors in general. Many investors have chosen to liquidate or reduce their equity positions and turn to fixed income. The clearest example of this occurred in the 10-year note, where its yield (which acts inversely to price) fell from 4% to 3.82%.

US banks lost more than $100 billion in equity value between Thursday and Friday, and European banks lost about another $50 billion in value, according to Reuters calculations.

In the US banking sector, reactions were swift, with First Republic Bank (NYSE: -16.5%) and PacWest falling -25%. Among the big corporations such as Bank of America (NYSE: ), JPMorgan (NYSE: ), Wells Fargo (NYSE: ), and Citigroup (NYSE:) fell 4-6%.

The regional banking index raised its weekly losses to -18%, its worst week since 2009. The banking index, which includes large and medium-sized banks, raised its losses for the week to more than -11%.

Meanwhile, the SPDR® S&P Regional Banking ETF (NYSE: ), which tracks the performance of U.S. regional banks, fell -8%, and the Invesco KBW Regional Banking ETF (NASDAQ: -6.37%) and index focused on large banks were down. -7.70%.

Friday’s biggest losers in the S&P 1500 financials:

– Backwest Bancorp (NASDAQ:) -24.2%

– First Republic Bank (NYSE:) -20%

– Signature Bank (NASDAQ: -13.7%)

Bancorp Customers (NYSE:) -11.8%

-Bank of Hawaii (NYSE:) -7.5%

– Axos Financial (NYSE:) -7.1%

– with me. Riley Financial (NASDAQ:) -6.9%

– East West Bancorp (NASDAQ:) -6.1%

The fear index on Wall Street rose in two days (Thursday and Friday) from 18.88 to 29.

In Europe, the Banking Index declined by -4.2%, similar to the decline in the IBEX Banking Index.

Some entities such as Deutsche Bank (ETR:) are left up to -10%, HSBC (NYSE:) more than -5%, the same, BNP Paribas (EPA:) -4.4%.

And not only that, but the consequences have spilled over to Alecta, Sweden’s largest pension fund which was SVB’s fourth largest shareholder at the end of last year after it doubled its stake in Bank of California. Alecta is also the fifth largest shareholder in First Republic Bank and the sixth largest owner of Signature Bank. Both banks also suffered huge losses.

5. Cause for concern?

The fact that the banking sector has been affected by all of this is due to investor concerns because SVB has historically been a solid and well-run bank, and of course, if it is now what it is, they fear how other, less solid banks might be. Moreover, they fear that their difficulties are the tip of the iceberg of problems pervasive in the sector, with corporate financing strains.

This is the case that Bill Ackman himself proposed a government bailout to save SVB. But this seems unlikely due to its irregular nature.

Currently, the bank will increase its capital by $1,750 million and will also receive another $500 million capital injection from General Atlantic, an investment fund closely related to the entity.

Things should not go further than that. It is a problem (and a big one) for the SVB, but the concerns about the sector in general are not justified and even less so by the big banks. The market’s sudden reaction seems to be somewhat exaggerated. It caused a great psychological effect that awakened the ancient market demons. But we already know that when something happens, investors sell first and then worry about seeing and analyzing what happened.

It is also true that the European banking sector, especially the Spanish sector, has seen a significant rise in recent months due to the hike in interest rates at the European Central Bank, so many investors have also benefited from selling and profit-taking. Spanish banks have appreciated +27% on average with CaixaBank (BME:) up +50% and in the rest of Europe more than double that.

At the moment, financial regulators in the United States have announced the closure of SVB due to illiquidity and bankruptcy, and announced measures to ensure that all of its insured deposits are protected and that all customers with insured funds will have full access to them by Monday at the latest. Those with uninsured deposits will be paid a dividend by the FDIC this week and will receive a certificate for the rest of their money, which will be returned upon the sale of the bank’s assets.

US Treasury Secretary Janet Yellen said the US banking system remains resilient and regulators have effective tools to deal with the consequences of the SVB collapse. His words were an attempt to reassure the markets and prevent further panic among investors.

Former Treasury Secretary, Lawrence Summers, also spoke out, stating that it should not be a risk to the financial system.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”