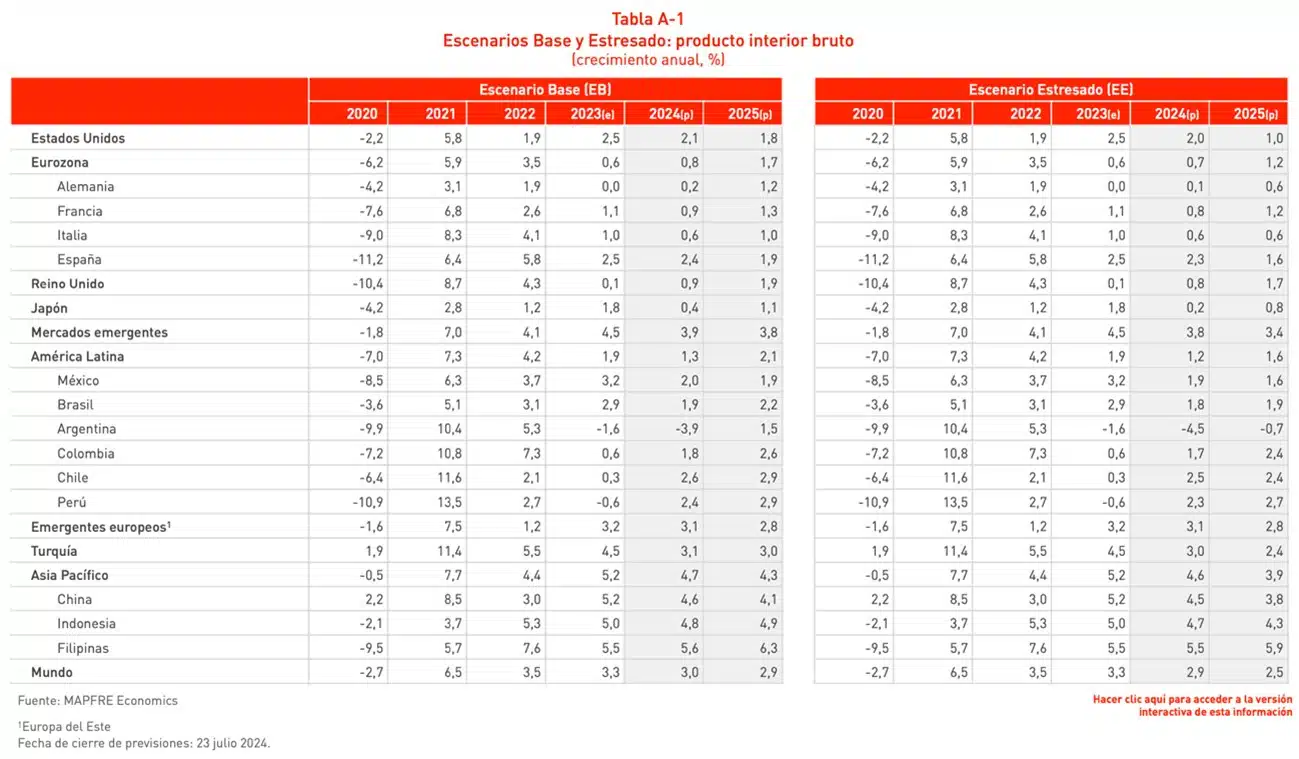

The global economy continues to slow, although it has managed to maintain positive growth thanks to inflation rates that have been gradually declining in recent months. In this context, MAPFRE Economics, MAPFRE’s research service, It expects growth of 3% by 2024 and 2.9% by 2025.Both are higher than the 2.6% expected in the previous forecasts for the two years. This was stated in the “Economic and Sectoral Panorama 2024: Perspectives towards the Second Quarter”, published by the Department of Studies and edited by Fundación MAPFRE.

Inflation continues to move in the right direction, although it has failed to reach the target. By 4.5% and 3.5% respectively.Among the obstacles are the continued pressure on services and the adjustment of salaries on the demand side, while on the supply side other challenges are crystallizing such as the disruption of supply chains linked to the Red Sea crisis and the evolution of raw material prices. The characteristics of each region in turn mean that the inflation horizon presents very different realities across the world and at very different levels of development.

In 2024, the balance of global risks is slightly tilted to the downside, highlighting geopolitical, governance and economic policy risks, and a potential transition to a less benign, but not recessive, scenario.

By geography, the United States will grow by 2.1% this year and 1.8% next year, maintaining the previous 2024 forecast and increasing by two-tenths of a percentage point in 2025. Average inflation is expected to be 3% and 2.4%, respectively. MAPFRE Research highlights that The labor market is beginning to show signs of weakness.With the unemployment rate rising to 4.1% in June from 3.8% in March, adding to the already negative leading indicators, the main risk to the US economy is high debt and deficit levels, at a time when, given healthy growth, the government should not be running deficits.

The euro area is expected to grow by 0.8% in 2024 and 1.7% in 2025, with average inflation of 2.3% and 2%, respectively. The performance of the European economy in the short term will depend largely on The coupling of forces between planned monetary easing and the return of fiscal rules, i.e. fiscal balance.

For its part, the Asia-Pacific region will record GDP growth of 4.7% this year and 4.3% next year, with average inflation of 0.9% and 1.7%, respectively, while Latin America will grow 1.3% in 2024 and 2.1% in 2025. Inflation will remain high at 8.5% in 2024, then slow to 7.6% next year.

“The current landscape offers a more balanced view of the overall economy. This phase of slowdown continues to raise some differences. In terms of activity, inflation and monetary policy, facing a difficult geopolitical scenario that opens a deeper gap.

Impact on the insurance sector

The outlook for the global insurance market in 2024 is positive, although lower than in 2023, with life insurance premiums expected to grow by 4.4% and non-life insurance premiums by 5.2%. This is in line with the good position the global economy is expected to perform throughout this year.

By 2025, the expected cyclical situation will improve, as with inflation more under control, financial conditions will again support consumption and investment, supporting a relatively favorable outlook for non-life premium growth with a projected growth of 5.4% and still benign enough to generate life business, which is expected to grow by around 7.9% year-on-year.

You can view the full report here

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”