Shares of Chinese companies listed in the United States are incurring heavy losses against the backdrop of the wave of the Chinese stock market crash and fears that they may be delisted from US stock exchanges:

Xi Jinping’s victory has raised concerns about China’s authoritarian and anti-business government. In addition, Xi appointed his supporters to one of China’s largest decision-making bodies;

The Covid Zero policy may be prolonged and the investment climate in China for both domestic and international companies may deteriorate;

The strained relations between Washington and Beijing may lead to a tighter regulation of trade cooperation; Companies that build their business model on bilateral cooperation between the two countries are preparing for an even worse period;

China’s Q3 macro data was mixed in tone and did not confirm the positive recovery that the bulls had been expecting. Despite GDP growth, consumption slowed significantly in September, unemployment rose and the real estate crisis continued to spread.

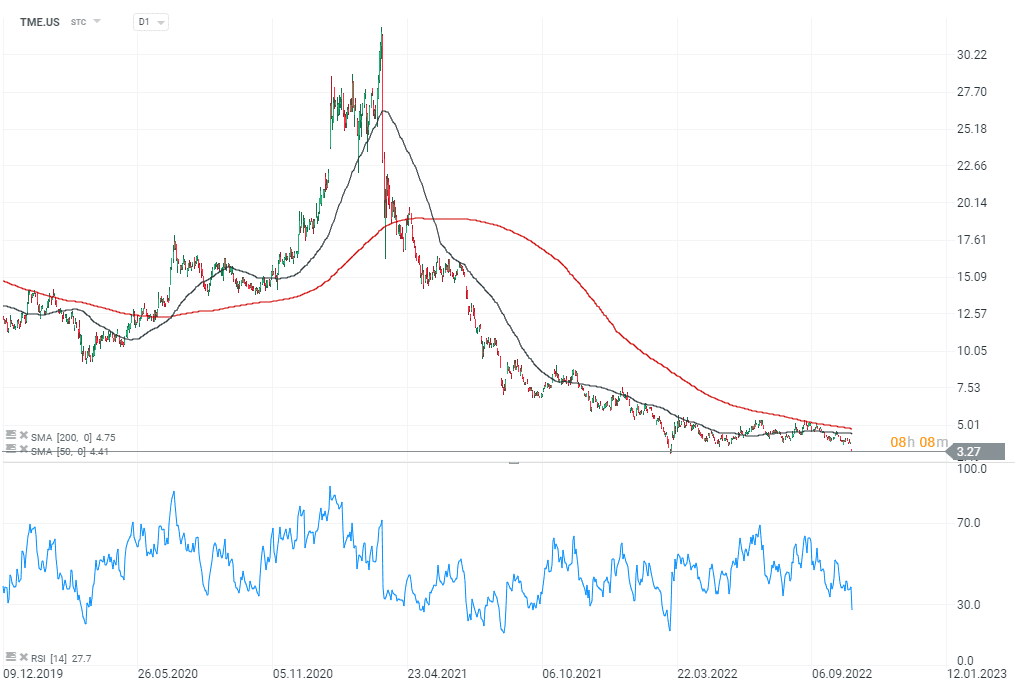

Tencent (TME.US) -14.5%, Ali Baba (BABA.US) -15.5%, Baidu (BIDU.US .)) -16%, Weibo (WB.US) -16.5%, Yum China (YUMCUS) -12%, NIO (NIO.US) -17%, Oriental New (EDU.US) – twenty%

.

Chinese companies dominate the list of worst-performing stocks after the US open today. Source: xStation5

“This report is provided for general information and educational purposes only. No opinion, analysis, price or other content constitutes investment advice or a recommendation within the meaning of Belizean law. Past performance does not necessarily indicate actual results. The information does so at its own risk.XTB will not be liable for any loss or damage, including, without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Contracts for Difference (“Contracts for Difference”) are leveraged products and involve a high level of risk. Make sure you understand the risks involved.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”